IIRF Online > Finance & Accounting > Finance > Corporate Finance > Fundamentals of Corporate Finance

Fundamentals of Corporate Finance by Futurelearn

Build your understanding of key financial concepts and techniques to create sound financial forecasts and company valuations.

Course Highlights

- Apply the concepts of time value of money, present value, future value, discounted cash flows and other basic principles of finance.

- Apply expert judgement in using the concepts and role efficient market hypothesis, capital assets pricing model, portfolio theory to optimize financial management.

- Apply techniques of time value of money, discounted cash flows in the valuation of share, bond and investment proposals.

- Perform fundamental company analysis, financial forecasting method, options valuation and numerical (pricing) and Black-Scholes model

- Evaluate a firm’s capital structure, debt and equity position and determine the optimal debt-equity position.

- Interpret the financial ratios and portfolio theory and practice management of a business.

- Calculate NPV, IRR, Pay Back Period, Profitability Index to evaluate projects.

Skills you will learn!

Curriculum

4 Topics

Course welcome

Free market economies part 1

Free market economies part 2

End of Week 1 wrap up

4 Topics

Weekly welcome

Corporate finance and ratio analysis part 1

Corporate finance and ratio analysis part 2

End of Week 2 wrap up

4 Topics

Weekly welcome

Company and stocks valuations part 1

Company and stocks valuations part 2

End of Week 3 wrap up

4 Topics

Weekly welcome

Options valuation pricing and trading analysis

Financial forecasting

End of course wrap up

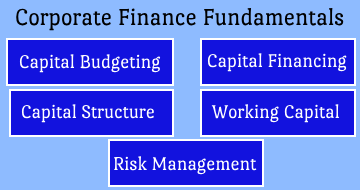

Fundamentals of Corporate Finance