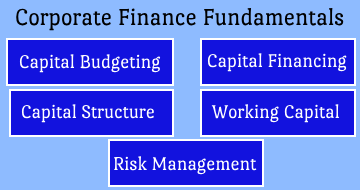

Corporate Finance Fundamentals by Coursera

Skills you will learn!

Curriculum

7 Topics

Course Introduction

Corporate finance overview

Players in corporate finance - primary market

Players in corporate finance - secondary market

Types of participants and transactions

Downloadable Files

Interactive Exercise 1

14 Topics

Capital investment overview

Net present value (NPV)

Terminal value

Unlocking the drivers of value

Enterprise value vs equity value

Internal rate of return (IRR)

Mergers and acquisitions

10-step acquisition process

Types of buyers

Acquisition valuation and analysis

Issues to consider when structuring a deal

Interactive exercise 2

Interactive exercise 3

Interactive Exercise 4

25 Topics

Capital financing overview

The business life cycle and funding life cycle

Capital structure

Weighted average cost of capital (WACC)

Capital stack

Types of equity

Sources of equity

Private equity and venture capital firms

Why use debt

Assessing debt capacity

Senior debt overview

Types of subordinated debt

Credit ratings and high yield debt

Mezzanine debt characteristics

Debt repayment profiles

Tradeoffs between debt and equity

Underwriting

Underwriting advisory services

Book building process and road show

Pricing the issue

Interactive exercise 5

Interactive exercise 6

Interactive exercise 7

Interactive exercise 8

Interactive exercise 9

5 Topics

Three main activities of corporate finance recap

Dividends and return of capital

Retained earnings and excess cash

Dividends vs share buyback

Interactive exercise 10

2 Topics

Roles in corporate finance

Summary

1 Topic

Qualified Assessment

Corporate Finance Fundamentals