The Corporate Finance Course by Udemy

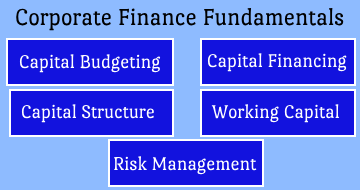

Corporate Governance, Capital Budgeting, Cost of Capital, Leverage, Working Capital: Complete Corporate Finance Training

Course Highlights

- Prepare for a corporate finance careers

- Impress interviewers by showing a strong an understanding of finance fundamentals and advanced topics concepts

- Acquire an understanding of corporate governance, capital budgeting, cost of capital, measures of leverage, and working capital management

Skills you will learn!

Curriculum

1 Topic

What Does the Course Cover?

21 Topics

Working Capital Management (Definition)

Liquidity Management

Liquidity Measures

Asset Management Ratios

Payables Turnover Ratio

Calculate the Number of Days of Payables

Liquidity Analysis (Example)

Comprehensive liquidity analysis

Operating and Cash Conversion Cycles

Calculate the Operating Cycle of a Company

Calculate the Cash Conversion Cycle of a Company

Net Daily Cash Position

Yields on short-term securities

Investment Policy Statement

Accounts Receivable Management

Inventory Management

Accounts Payable Management

Short-term Bank Funding Sources

Short-term Non-bank Funding Sources

Working Capital Management

Practice questions (Working Capital Management)-answers

29 Topics

The Capital Budgeting Process

Capital Budgeting (Basic Principles)

Basic Principles of Capital Budgeting

Engaging with Multiple Projects at a Time

Engaging with Multiple Projects at a Time

Net Present Value (NPV)

Net Present Value: Example

Net Present Value: Example

Internal Rate of Return (IRR)

Internal Rate of Return (IRR)

Payback Period

Payback Period

Discounted Payback Period (DPBP)

Discounted Payback Period (DPBP)

Average Accounting Rate of Return (AAR)

Average Accounting Rate of Return (AAR)

Profitability Index (PI)

Profitability Index (PI)

NPV Profile

NPV Profile

NPV vs IRR

Compare the NPV and IRR Methods

Problems Associated with IRR

Problems Associated with IRR

Problems Associated with IRR

The Relation Between NPV and Share Price

Capital Budgeting (All Questions)

Practice Questions (Capital Budgeting)

Practice Questions (Answers with explanations)

31 Topics

The Weighted Average Cost of Capital (WACC)

The Weighted Average Cost of Capital (WACC)

Effect of Taxes on the Cost of Capital

Use of Target Capital Structure in Estimating WACC

Use of Target Capital Structure in Estimating WACC

Marginal Cost of Capital (MCC)

Marginal Cost of Capital (MCC)

The MCC's Role in Determining the NPV

The MCC's Role in Determining the NPV

Cost of Debt

Cost of Preferred Stock

Cost of Preferred Stock

Cost of Equity (Using CAPM)

Calculate the Cost of Equity

CAPM (Components)

Components of CAPM

Cost of Equity (Using the Dividend Discount Model)

Cost of Equity (Using the Bond Yield Plus Risk Premium Approach)

Calculate and Interpret Beta

Calculate and Interpret Beta

Calculate a Project's Beta

Calculate a Project's Beta

Estimate the Cost of Equity for Developing Countries

Estimate the Cost of Equity for Developing Countries

Marginal Cost of Capital Schedule

Marginal Cost of Capital Schedule

Flotation Costs

Flotation Costs

Cost of Capital

Practice Questions (Cost of Capital)

Practice Questions (Answers with explanations)

12 Topics

Case Study (Introduction)

Organizing Inputs Into Drivers Sheet

Sales Forecast Sheet

Preparing a Fixed Asset Rollforward Schedule

Calculate Cash Impact of Extra Working Capital

Debt Repayments and Interest Expenses

Project's P&L Sheet

Project’s Cash Flows

WACC

Calculate Beta in Excel

Discounting Project Cash Flows

Performance Evaluation and Sensitivity Analysis

11 Topics

Measures of Leverage

Business and Financial Risk

Calculate the Degree of Operating Leverage (DOL)

Calculate the Degree of Financial Leverage (DFL)

Calculate the Degree of Total Leverage (DTL)

The Effect of Financial Leverage on a Company's NI and ROE

Calculate the Breakeven Quantity of Sales

Calculate the Operating Breakeven Quantity of Sales

Measures of Leverage

Practice Questions (Measures of Leverage)

Practice Questions (Answers with explanations)

16 Topics

Corporate Governance: Description

Stakeholder Groups and Their Interests

Stakeholder Conflicts

Stakeholder Management

Governance Mechanisms

Board of Directors

Board of Directors Committees

Factors Influencing Corporate Governance

Corporate Governance: Risks and Benefits

Principles of Corporate Governance Analysis

Environmental Factors and Social Considerations in Investment Analysis

ESG Investing

ESG Investing vs Fiduciary Duties

Corporate Governance

Practice Questions (Corporate Governance and ESG: An Introduction)

Practice Questions (Answers with explanations)

7 Topics

Introduction

Setting up the Financial Calculator

Basic Calculations

Time Value of Money

Cash Flow Analysis

Statistics

Depreciation and Breakeven

1 Topic

Formula sheet

The Corporate Finance Course